Social security delay calculator

Must be downloaded and installed on your computer. The calculator provides an estimate of your Social Security benefits based on your earnings history and age.

When Should You Take Social Security

Ad Deciding When To Claim Your Social Security Benefits Can Be Tricky.

. If you start receiving benefits at age 66 you get 100 percent of your monthly benefit. Year of Birth 1. Take Out The Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points.

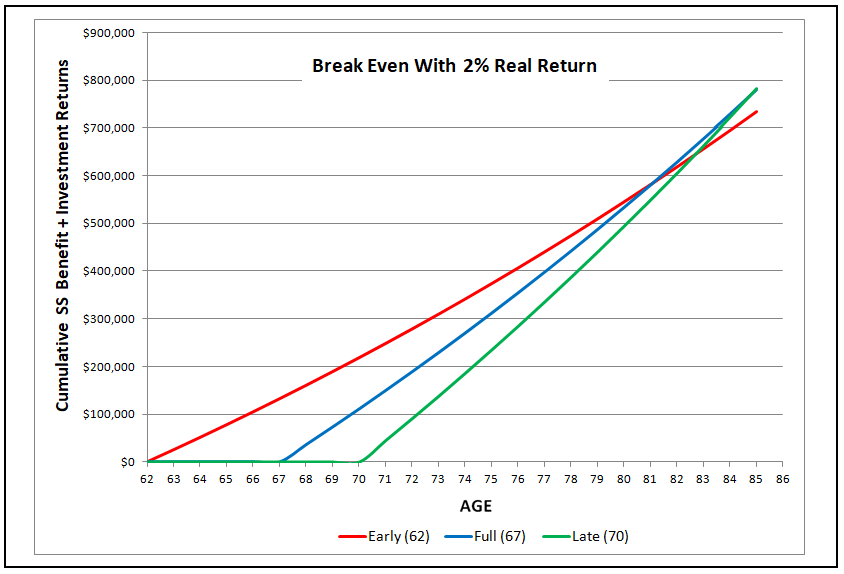

Full Retirement and Age 62 Benefit By Year Of Birth. The break-even calculator in Social Security Timing shows the exact age at which your clients can expect a decision to delay Social Security to pay off. So benefit estimates made by the Quick Calculator are rough.

So benefit estimates made by the Quick Calculator are rough. My Social Security Retirement Calculator. A 1000 retirement benefit.

Social Security website provides calculators for various purposes. Yes there is a limit to how much you can receive in Social Security benefits. In the case of early retirement a benefit is.

Over your lifetime which filing age will net you the highest total payments from Social Security. The estimate includes WEP reduction. Here are 10 Social Security calculators worth trying.

This Social Security break even calculator helps answer the question. Early retirement reduces benefits. Your monthly benefit however is 30 lower than.

For 2022 its 4194month for those who retire at age 70. For example the default values which are based on a real scenario indicated there is a benefit to delaying the collection of payments from the Social Security system. With delayed retirement credits a person can receive his or her largest benefit by retiring at age 70.

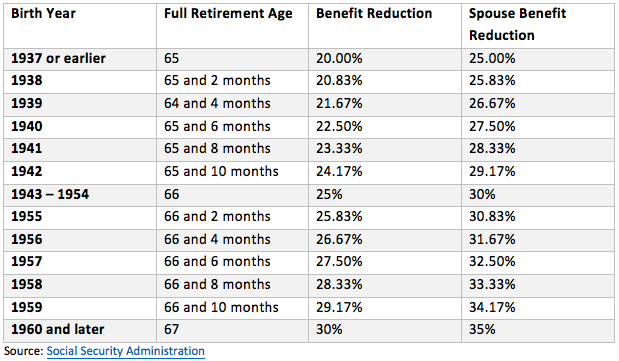

51 rows If you were born between 1943 and 1954 your full retirement age is 66. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which. At Age 62 3.

The maximum Social Security benefit changes each year. When generating a report for a single. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

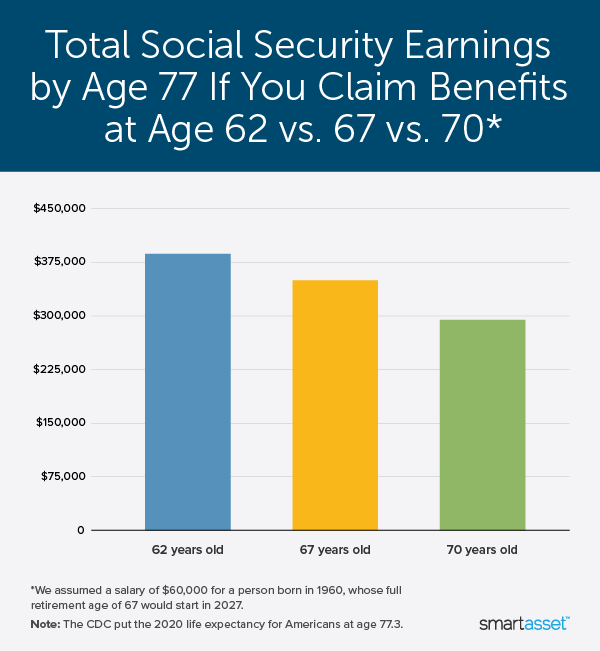

If you claim at 62 instead of waiting until 67 youd receive 63000 over five years you wouldnt have received had you delayed. If youve already reached full retirement age you can choose to start receiving benefits before the month you apply. Full normal Retirement Age.

Our tool also helps you see what percentage of daily expenses. Social Securitys Retirement Estimator is now available for people who have signed up for Medicare but have not yet signed up for Social Security because they are delaying. The Quick Calculator compliments of Social Security estimates your future checks but this one is about as simple as they come.

Months between age 62 and full retirement age 2. The answer is when you are both 78 years and eight months or 1167 years 42000 3600 after your FRA. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity.

After this point your co-worker will earn more over their. Get the most precise estimate of your retirement disability and survivors benefits.

1

When Are You Money Ahead On Social Security Morningstar

Deadline Passed For Social Security File And Suspend Security Application Social Security Social Security Benefits

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

/GettyImages-149357059-b06074af5ea4494aba83d73a3755f261.jpg)

How Do I Calculate My Social Security Breakeven Age

This Chart Shows Why You Shouldn T Wait To Claim Social Security

Social Security

Social Security Benefit Calculation Spreadsheet Spreadsheet Template Track Investments Spreadsheet

What Is The Maximum Social Security Retirement Benefit Retirement Benefits Saving For Retirement Retirement Calculator

1

1

Social Security At 62 67 Or 70 How To Decide Seeking Alpha

This Chart Shows Why You Shouldn T Wait To Claim Social Security

How Early Retirement Reduces Projected Social Security Benefits

How Does Social Security Work The Motley Fool

Breaking Down Social Security Retirement Benefits By Age Simplywise

A Comprehensive Guide To Social Security After Divorce